Ironically a day after the 144th Open Championship I am at the Surrey Research Park in Guildford helping a group of entrepreneurs practice their pitching though not on the golf course! Its part of the University of Surrey’s Investor Readiness Programme that brings together fledgling business owners seeking early stage funding.

The programme, spread over 3 days and featuring a range of accountants, lawyers, former CEO’s and government officials, is one reason why University of Surrey ranks among the top 3 incubator centres in the UK. I’ve been invited along to make the programme more interactive and will be using facilitation tools and techniques often found in a Knowledge Management Toolkit.

My formal brief for the afternoon on Day One is two fold:

- Get the businesses to think about a possible exit strategy

- Begin the process of pitiching to investors

My unstated and informal brief:

- Create an environment that is conducive to sharing knowledge as a community in the future.

Planning for exit

Few businesses begin life thinking about how they might hand it over and transfer their knowledge. But investors are keen to know what their exit strategy is likely to be and whether it will survive their departure.

Since many embryonic businesses are centred on a bright individual who often holds the key to the Intellectual Property ‘door’ it is essential that good Knowledge & Information governance practices are adopted from Day One so that it can withstand his or her departure.

Simple steps such as cataloguing and storing of formal governance meetings are essential: Due diligence professionals will demand such documentation so better to have assembled it from the get go rather than incur cost later.

I begin by asking this simple question:

Regular readers of my postings will be familiar with this technique (Reverse Brainstorm) and the 6 step process I use to run it:

- Get into groups (4 is a good #)

- List how to make ‘it’ fail

- Go see what others have done

- Add what you like to your list

- Choose the most important 3

- Share in plenary

The aim of this session which I ran with the programme director James Macfarlane was to get the businesses to develop their own checklist and key performance indicators (KPI’s) to measure how they are progressing along their journey.

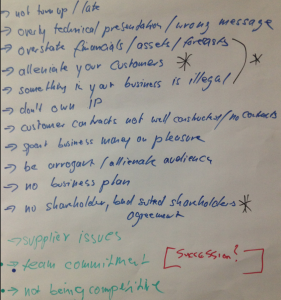

Here’s one of the team’s workings and below the 6 major issues likely to derail an exit prior to and including the due diligence phase:

- Failure to protect their Intellectual Property

- Lack of clarity among team over personal and organisation’s exit strategy

- Failure to plan for departures and who will succeed

- Failure to meet over optimistic targets

- Misrepresentation of warranty information

- Failure to develop testimonials and reference sites

Testing what others heard

Having recognised the importance of at least thinking about the exit strategy before making a pitch for funds James and I now challenged each business to present their proposition in 90 secconds using these headings. I gave these instructions:

- Break into pairs

- Take 5 minutes to plan what you are going to say

- Give the pitch to your partner

- Listen to your partner’s pitch

- Back in plenary: make your partner’s pitch to the whole group

- In 2 groups discuss what you liked about styles and content

- Debrief in plenary and vote for the most compelling proposition

Listening (and watching) well is important to presenting well and the title ‘I heard you to say and understood you to mean’ is a pointer to the need to focus on different ways to tell the story of the business opportunity to different audiences.

Listening (and watching) well is important to presenting well and the title ‘I heard you to say and understood you to mean’ is a pointer to the need to focus on different ways to tell the story of the business opportunity to different audiences.

We encouraged each presenter to think about how the message they are giving will be interpreted and left them with this metaphor.

Imagine you are writing a press release, this part of your pitch is the headline and the synopsis of the article. The aim is to get questions (in more detail) from interested investors as a result of this (very) brief pitch.

And finally

As always when you work with bright people you learn.

- The importance of revenue recognition in the software industry when buying or selling a business – for a good description see: SOP 97-2

- The point at which you do a business plan is ‘when I becomes we’

- A good strategy should be capable of being represented as a picture

- When promoting your business remember to say ‘what it does not how it does it’

- People buy you not the numbers and they buy the story you tell: if you can’t say what difference your ‘product’ will make then investors won’t be interested either